Advice for Buyers

Advice for Buyers

Determine your individual needs

The reasons for buying property vary widely from one person to another. It is therefore extremely important to discuss your individual needs with your real estate broker before visiting a property.

Before making an appointment with your real estate broker, draw up a list of the factors important to you and determine your individual needs such as locality, price, type of property, number of bedrooms, surroundings, public utilities, and so on.

Check with your financial institution to find out how much you can afford to carry as a mortgage and have the loan amount preauthorized.

Talk to a RE/MAX broker

Once you have analyzed your individual needs, talk to your neighbourhood RE/MAX broker. If you are moving out of the area in which you currently reside, your local broker will be able to refer you to a professional RE/MAX broker in the area of interest to you.

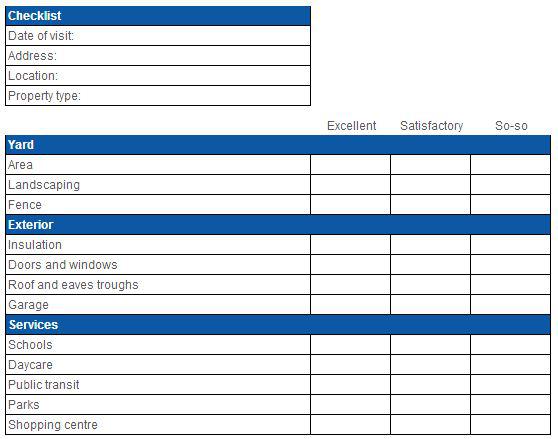

Checklist for visiting a property

Here is a checklist to use each time you visit a property. It will help you compare the various properties you visit and more easily come to a decision as to which property is best suited to your needs.

You've found your dream house?

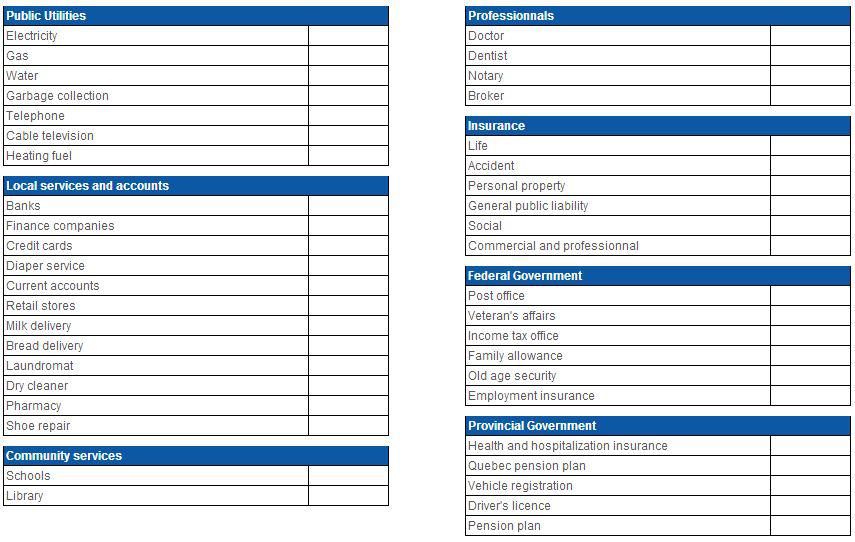

Remember to notify current service providers prior to moving and to take action as required when settling into your new location.

Moving Day Checklist:

-

Read all meters

-

Lower or turn off heating

-

Turn off all lights

-

Shut and lock all doors, latch all windows

-

Turn over keys to new occupants

-

Have telephone disconnected

-

Take out all garbage

Expenses to allow for when buying property

-

Inspection of property by building expert

-

Mortgage arrangements with bank:

-

Conventional loan (20 % cash)

-

Loan insured by CHMC (less than 20 %)

-

Deposit to accompany Offer to Purchase

Expenses to allow for when signing before notary

-

Deposit to accompany Offer to Purchase

-

Tax redistribution and refunds: refunds are calculated from the date of the signing of the deed of sale. You are responsible for reimbursing the seller for the number of days paid to date for the following : Municipal taxes, School taxes.

-

Heating oil tank: the seller is required to have the tank filled on the day of the signing of the deed of sale and submit the invoice to the notary for reimbursement in full by the buyer.

-

Electricity meter (Hydro Quebec): the buyer and the seller must notify Hydro Quebec of the date the property is scheduled to change hands, have the meter read, and ensure that all amounts owing are properly allocated.

-

Homeowner insurance: upon signing of the deed of sale, you must present proof that you have contracted homeowner's insurance in an amount equal to or greater than the mortgage on the property.

Expenses to allow for after having signed the deed of sale

-

Land transfer or "Welcome tax": the municipality in which you settle will bill you within four (4) to six (6) months of the signing of the deed of sale in an amount based upon the selling price and scaled as follows:

-

0.50 % of amounts up to $50,000

-

% of amounts between $50,000 and $250,000

-

Province of Quebec, excluding Montreal:

-

1.50 % of amounts exceeding $250,000

-

Montreal only:

-

1.50 % of amounts between $250,000 and $500,000

-

2% of amounts exceeding $500,000

-

Moving, painting, interior and exterior decoration, etc.